NEW DATA AVAILABLE TO PURCHASE

See how established Banks, Building Societies and Challenger Banks perform when a customer tries to move a simple £120,000 mortgage

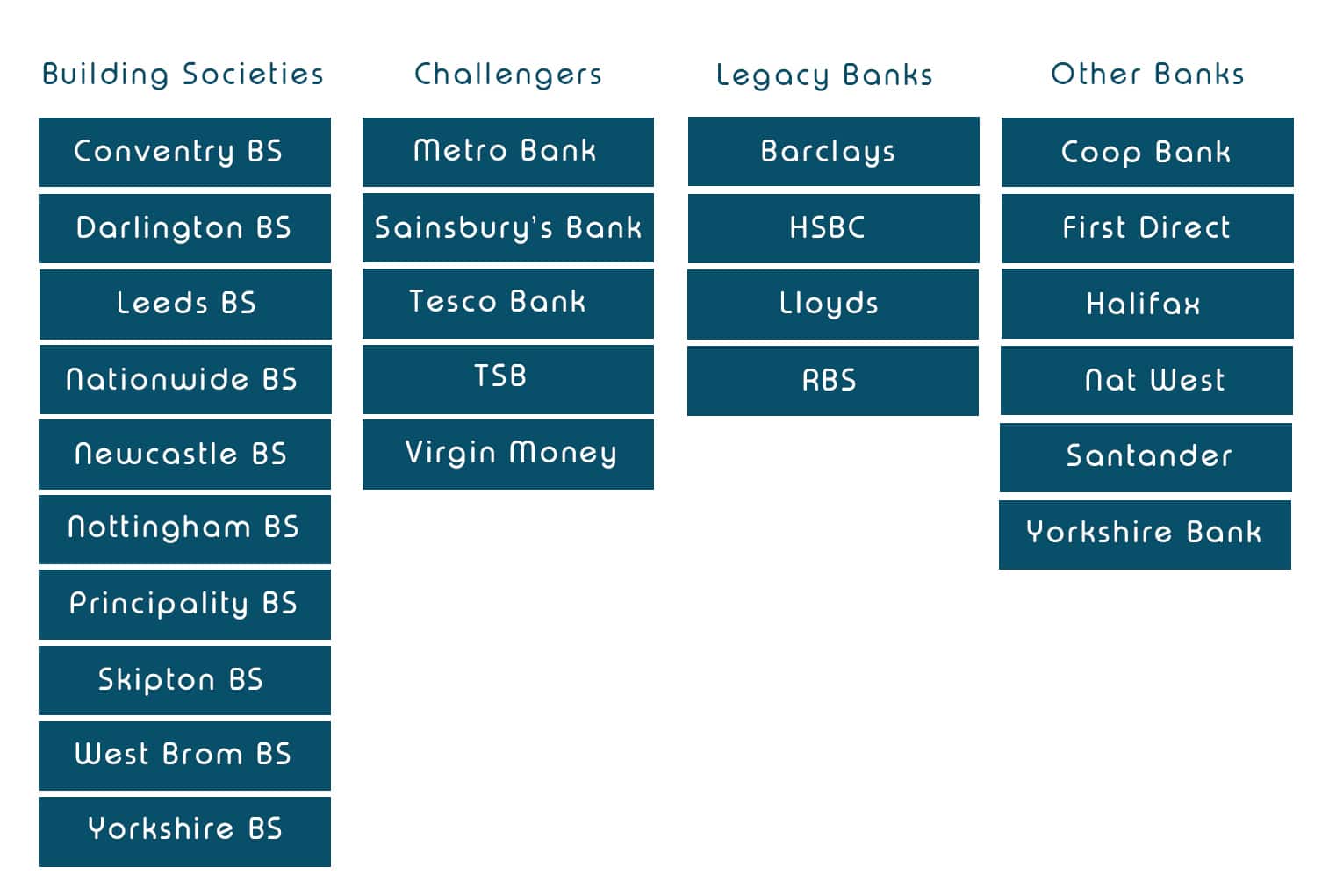

- Exclusive data from 25 establishments across the country

- What really happens in practice when a member of the public approaches a major player for re-mortgage information

- In depth insight into competitor activity

- Clear presentation of opportunities for improvement

Contact us via the link below to find about more and purchase the data:

How do you perform against the established Banks, Building Societies and Challenger Banks when providing mortgages to your customers? Find out here in our in-depth and exclusive mystery shopping research study, available now.

What’s included in the full data set?

Wait times

Who insists on an appointment for mortgage advice? How long it takes to get an appointment (all distribution channels)

Stages in the process

How many stages in the mortgage process.

Process time

Time to go through each stage in the mortgage process.

Differences in your process

What are the key differences between YOUR PROCESS v shortest mortgage process.

Web chat

Web chat effectiveness scored for those that use it

Online execution

Who offers an online application execution only.

Other technology

Who offers advice via video and timings.

Best practice

A summary of how your re-mortgage service operates versus best practice from a customer’s point of view.

What are the benefits to you?

Here’s what is included:

Reduce costs

Can reduce cost by removing duplication OR increase Mortgage Advisor Productivity.

Competitor activity

You will have a clear picture of the competitor activity and can use the research as a guide to compete on service.

Transformation & staff training

The research will assist any transformation programme and can be used to motivate and train staff on competitor activity.

Significant cost savings

Making improvements based on the research can lead to significant cost savings.